As November 1st looms on the horizon, Amazon’s new reimbursement policy is set to shake things up for FBA sellers everywhere. With the clock ticking, it’s no surprise that an alarming number of companies are ramping up their pitches, promising the sun, the stars, and every dollar in between if you let them audit your account.

But before you dive headfirst into the glittering promises, it’s crucial to recognize the red flags—especially those companies that offer to create apocryphal invoices on your behalf. Here’s why you should proceed with caution and choose your auditing partner wisely.

The New Policy and the Surge in Auditing Offers

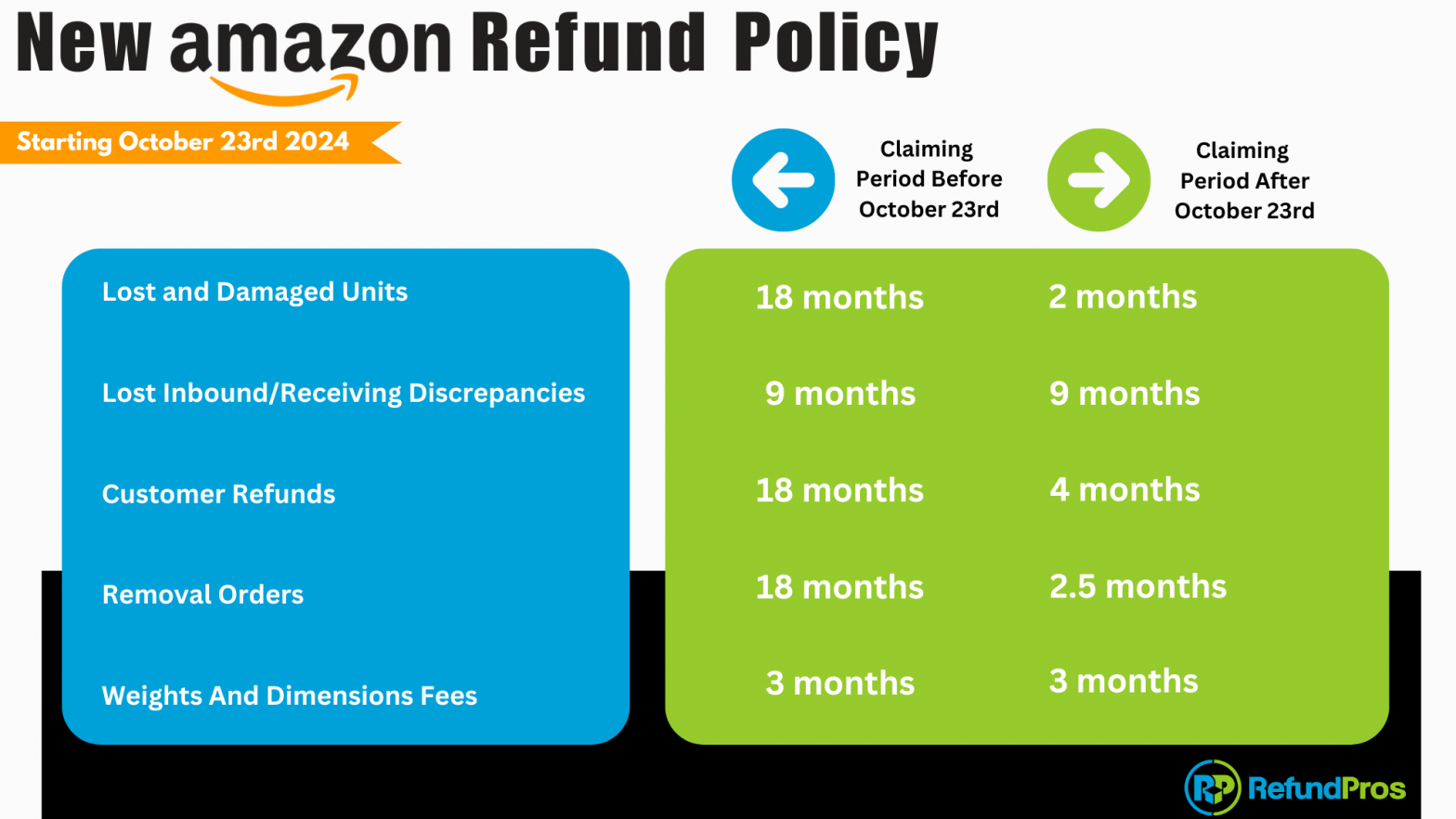

Amazon’s upcoming reimbursement policy, effective November 1st, introduces significant changes aimed at streamlining the reimbursement process and improving accuracy. Here’s a breakdown of what to expect:

Changes in Reimbursement Timelines

The policy will impact reimbursement timelines. While Amazon aims to expedite the reimbursement process, the increased scrutiny may lead to longer review periods for claims that require additional validation. Sellers should be prepared for potential delays and ensure they have the necessary documentation readily available.

Focus on Proactive Measures

Amazon is emphasizing proactive measures to prevent issues before they arise. This includes improved tracking and reporting mechanisms to address discrepancies early. However, sellers will need to be more vigilant in monitoring their inventory and addressing issues promptly to avoid complications with their claims.

Unfortunately, this desperation to take advantage of the retrospective period has led to a rise in opportunistic companies promising to recover every last penny by any means necessary. Some are going as far as to offer not just assistance with packing slips but to create fake invoices to support lost inbound cases.

The Allure of Fake Invoices

At first glance, the offer might seem tempting. After all, the idea of recovering money from lost inbound cases without the proper documentation could sound like a dream come true. However, this “help” is not just questionable—it’s downright dangerous.

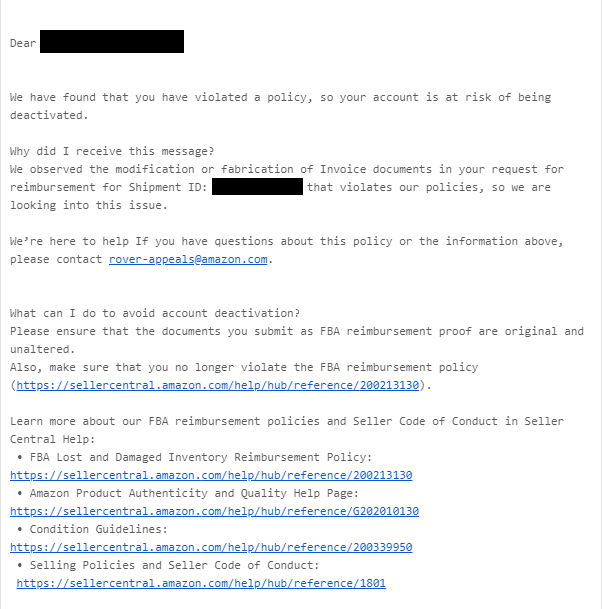

Risk of Account Suspension

Amazon’s policies are stringent, and violating them can have serious consequences. Submitting fake invoices is a direct breach of Amazon’s terms of service.

Even if it seems like a quick fix, getting caught could lead to more than just losing out on reimbursements—it could result in your account being suspended or even permanently deactivated. The potential loss of your Amazon seller account is a risk that far outweighs any short-term financial gain.

Compromised Integrity

Choosing an auditing partner that resorts to creating fake invoices jeopardizes the integrity of your account. Your business reputation and operational stability are at stake.

Companies that cut corners to recover money for you are likely to have a lax approach to compliance and ethical standards, which could have long-lasting repercussions for your business.

Long-Term Impact on Your Business

Even if you manage to evade detection initially, the long-term impact of working with a disreputable auditing partner can be severe. An account that’s flagged for suspicious activity might face heightened scrutiny, making it harder to resolve legitimate issues in the future.

How to Choose a Reputable Auditing Partner

With the stakes so high, it’s essential to carefully evaluate potential auditing partners. Here are some tips to ensure you’re making a wise choice:

1. Check Their Track Record

Look for partners with a proven history of success and integrity. Review their client testimonials and case studies, and don’t hesitate to ask for references. A reputable company will be transparent about their experience and happy to provide evidence of their successful track record.

2. Request a Free Audit

A trustworthy auditing partner should be willing to offer a free initial audit. This allows you to gauge their expertise and approach without committing financially. Use this opportunity to assess their thoroughness and professionalism.

3. Compare Services

Don’t settle for the first offer you receive. Pay attention to what each company is promising and ensure that their methods align with Amazon’s policies.

4. Evaluate Their Compliance

Make sure that the auditing partner strictly adheres to Amazon’s guidelines. They should prioritize compliance and transparency in all their operations. A good auditing partner will focus on legitimate recovery strategies and provide support that aligns with Amazon’s requirements.

The upcoming changes to Amazon’s reimbursement policy are creating a whirlwind of activity in the auditing sector. While it’s tempting to jump at offers that promise quick fixes, it’s crucial to remember that not all that glitters is gold. Protect your business by choosing an auditing partner with integrity, experience, and a commitment to ethical practices. Your account’s integrity and your long-term success depend on it. So, tread carefully, ask the right questions, and make an informed choice to ensure that you’re partnering with a company that will genuinely support your business while keeping you in compliance with Amazon’s policies.